Writing messages, chatting, sending pictures, making phone calls. Functions that most of us use every day via the messenger service „WhatsApp“. It is possible that a new feature for German users will be added in the not too distant future: an integrated payment service. What still runs under „dreams of the future“ for us, Indian WhatsApp users can already use. What can WhatsApp Payment do? Why did the roll-out in Brazil fail? And when could it be so far in Germany? The current status of the payment service of the popular messenger.

Sending money uncomplicated as well as quick and easy via the currently running chat of the world’s most popular chat service – After more than two and a half years of waiting, WhatsApp, the instant messaging service that has been part of Facebook since 2014, launched its payment feature in India[1].

Paying directly via WhatsApp or sending money to friends and acquaintances for free – WhatsApp is jumping on a bandwagon that many see racing straight towards the future of payment. It’s all about mobile payments. In many Asian countries, digital payment via mobile devices has enjoyed great acceptance for quite some time.

In Germany, too, the number of users who are increasingly turning to modern, contactless payment methods and have a positive attitude towards it is rising. In the course of this year alone, this figure increased from six to twelve percent.[2] compared to 2019. Besides the (hygiene) concerns related to the Corona pandemic, this is mainly due to the

- Speed

- Simplicity of money transfer

- Convenience

- Uncomplicated purchasing

and payment process

Facebook is thus offering a payment function in a Messenger that is used by a large proportion of people around the world. So in the future, there may be no getting around the new payment feature – if it is made available in more countries and markets.

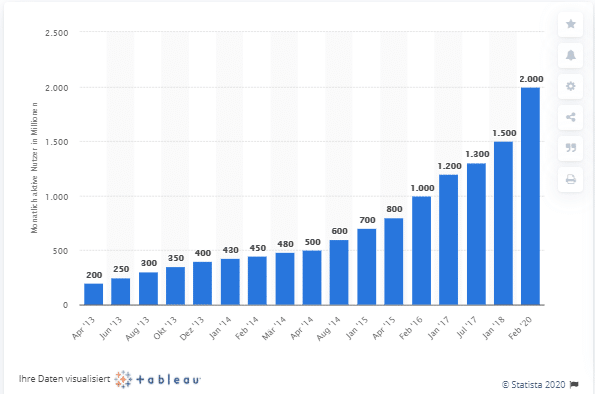

WhatsApp: popularity and user numbers continue to rise

Because the popularity of WhatsApp has not only remained unbroken for years. It is still constantly on the rise. Around 80 percent of all Germans use the messenger.[3] (as of October 2020). That is four percent more than last year. Globally, the picture is no different. With two billion active users, WhatsApp is the most popular messaging app internationally, well ahead of Facebook Messenger (1.3 billion users) and the Chinese chat service WeChat (1.2 billion users).

Evolution of monthly active WhatsApp users worldwide (in millions, source: Statista.com)

WhatsApp is particularly popular in India, with 96 percent of all smartphone users turning to WhatsApp for messenger communication.

Hence, the conditions were more than favorable for a mobile payment launch in general and WhatsApp Pay in particular in India:

- With 400 million active users, India belongs

for WhatsApp to the largest markets - Card payments enjoy great popularity in the giant South Asian country.

far less popular than in Europe, for example.

Requirements & Functionality

„Starting today, people across India can send money through WhatsApp. This secure payment method makes transferring money as easy as sending a message.“

With these words, taken from a blog post published to coincide with the release, WhatsApp announced the launch of its new in-app payment service. This ended a wait of over two and a half years. For already since the beginning of 2018.[4] a beta phase was run in India for a proprietary digital payment feature that can be used via smartphones. The payment function was developed together with the National Payments Corporation of India (NPCI), an umbrella organization for the operation of payment systems for Indian private customers. It uses the so-called Unified Payment Interface (UPI), which facilitates transactions between (a total of 160 supporting) banks. It is one of the

first authenticity payment systems in the country. Facebook is partnering with India’s own leading banks and financial institutions for WhatsApp Pay, including Axis Bank, HDFC Bank, State Bank of India and Jio Payments Bank.

To send or receive money directly through the app, the user needs two things:

- an Indian bank account

- an Indian debit card

And this is how (in simplified summary) the service works:

First, you select the contact you want to send money to in the app. Once the person in question has been selected, the transaction can be made to the account of the friend, acquaintance or family member directly via WhatsApp. To do this, the messenger sends the corresponding instruction to the respective bank. The bank initiates the money transfer between the sender’s account and the recipient’s account via the real-time payment system UPI. A few seconds later, the transaction is completed.

Currently, you can send up to 5,000 Indian rupees, a little over 55 euros, in one transaction.[5].

Conflicts after introduction in Brazil

However, the introduction (as well as the first announcements) of the mobile payment service did not go so smoothly. On the contrary. In Brazil, WhatsApp Pay was stopped again shortly after its market launch in the summer of 2020.[6]. After just one week. Facebook planned to expand WhatsApp Pay to many other countries and the entire Facebook platform ecosystem as quickly as possible after its successful launch in Brazil. The launch in the South American country was initially almost expected and did not come as a surprise. After all, Brazil is one of the Messenger’s largest markets, along with India. More than 100 million of a total of around 210 million inhabitants use Instant Messenger.

WhatsApp Pay ultimately failed due to the lack of approval. Facebook rolled out the new service in Brazil without such a permit. Facebook took the view that it was merely acting as a payment intermediary and therefore did not need authorisation. The Brazilian Central Bank and the Economic Board of Directors took a different view, fearing that WhatsApp Pay would cause lasting damage to the Brazilian economy.

And: possible competitive advantages for Messenger, which is so popular with the population. The focus was also on the question of protecting users‘ personal data. In short: Facebook rowed back and WhatsApp Pay was taken off the market in Brazil for the time being.

Not everything went smoothly in India either. Shortly after the announcement of the market launch a few months ago, the Indian Competition Commission came on the scene. Complaints arose against WhatsApp’s plans, which the competition authorities had to investigate. As in Brazil, the concern was about the „unfair competitive advantage“.

Is WhatsApp Pay coming to Germany?

Whether WhatsApp Pay will soon be available in other European countries, and thus perhaps soon in Germany, is not yet known. Facebook and Mark Zuckerberg are keeping a low profile on this question, especially since they first want to wait and see how and whether the new payment function is accepted and used by users in India as desired. The experiences in Brazil will probably also ensure that Facebook acts a little more cautiously in the future – not least with regard to big announcements and goals communicated via the press.

Because originally the goal formulated at the beginning of 2020 was: The payment feature should be rolled out in several countries by the middle of 2020. However, WhatsApp is still far away from this at the moment. In which regions and countries the payment function is still planned and whether Germany will be included, Zuckerberg could not (or did not want to) reveal at the beginning of November 2020.[7].

But one thing is also certain: some innovative players on the market, such as the smartphone bank N26 but also Deutsche Bank, are already diligently communicating and discussing the many possibilities of the WhatsApp payment feature and online banking via WhatsApp with their German customers.[8].

Sources:

[1]WhatsApp Pay launches in India: Sending money via chat – teltarif.de News

[2]https://www.springerprofessional.de/mobile-payment/handel/verbraucher-wollen-neue-bezahlformen-flaechendeckend/18252864

[3]Always up to date: WhatsApp user numbers, data and statistics for Germany (messengerpeople.com)

[4]Pay via WhatsApp: Next country gets payment function – CHIP

[5]Set up WhatsApp Pay: Only 6 steps are needed – Apps – futurezone.co.uk

[6]WhatsApp Pay: What potential does the payment service really have? – internetworld.com

[7]Pay via WhatsApp: Next country gets payment function – CHIP

[8]Online banking via WhatsApp? Banking veteran reinvents himself – Digital Life – futurezone.co.uk