Germany Finance, the working group of the financial centres in Germany, has published the German Fintech Report 2021 for the first time. The comprehensive study shows how diverse the German fintech industry is and where its focus lies. This was based on data on the German fintech ecosystem from the startup platform Startbase, which is operated by the Stuttgart Stock Exchange Group.

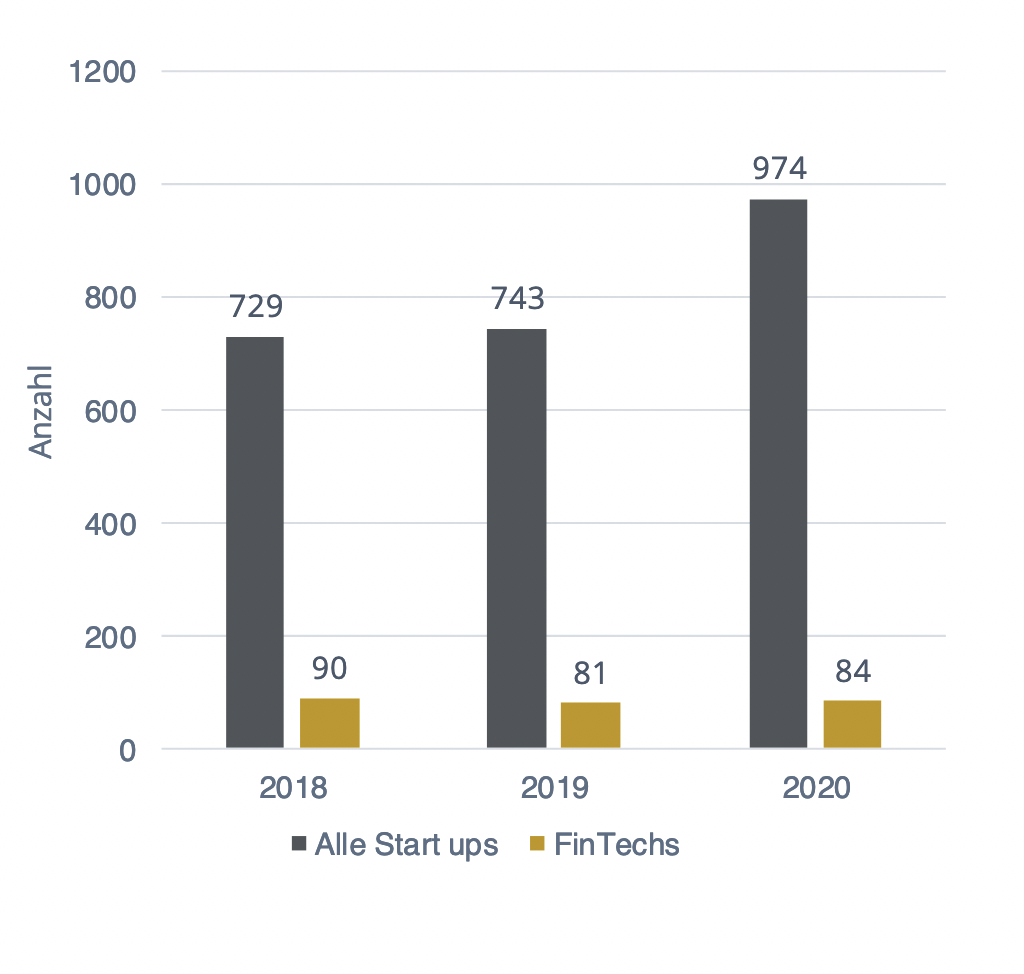

According to the German Fintech Report, there are currently 639 active FinTechs in Germany. Between 2018 and 2020, the study identifies 243 fintech startups – that’s about ten percent of all startups in Germany. Fintech is thus the second strongest sector in terms of start-up activity in the German start-up ecosystem after information and communication technology.

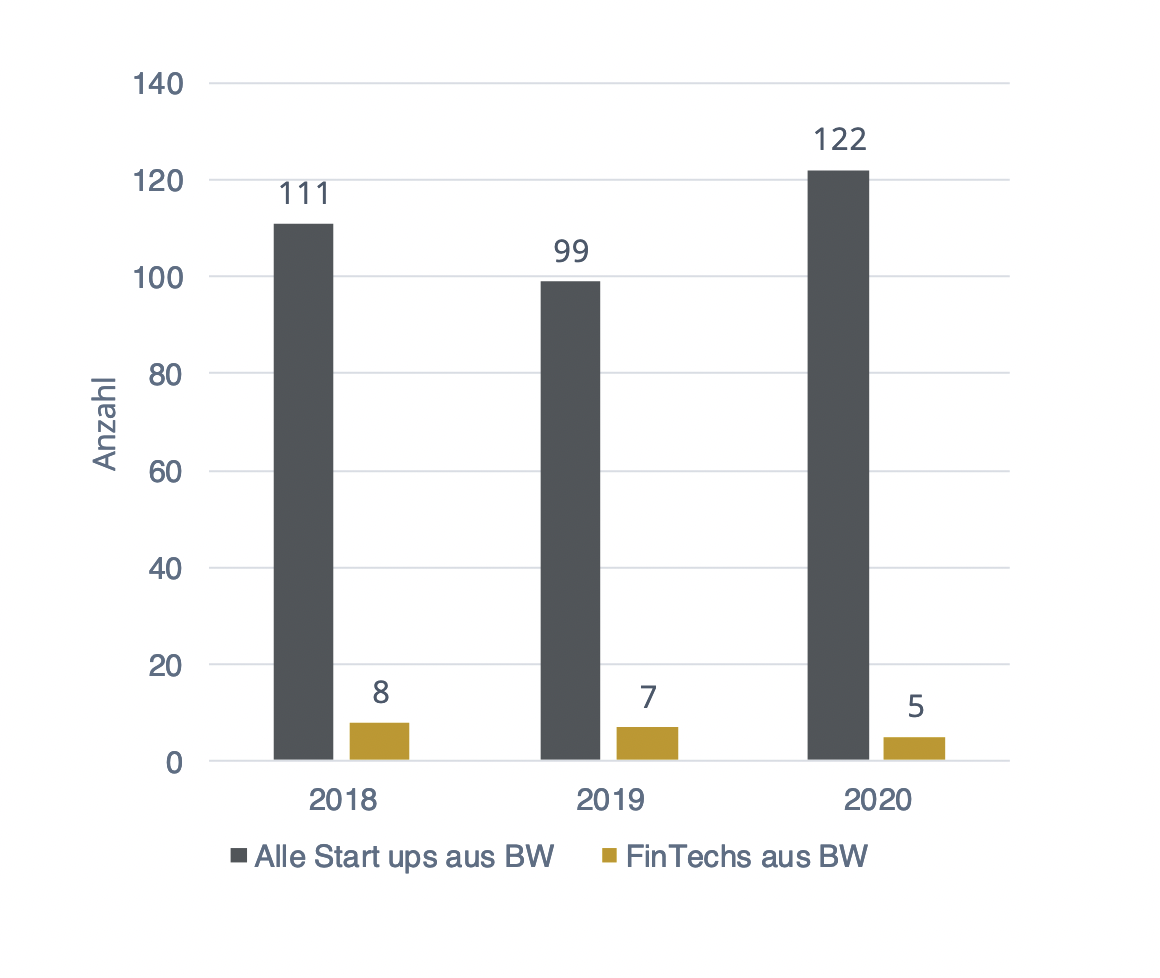

Currently, the smallest German fintech hub is located in Baden-Württemberg. Around eight percent of all fintechs have their headquarters there. The state does not currently form a clearly defined cluster. Young fintechs in Baden-Württemberg are primarily dedicated to the area of personal financial management: the companies want to help private customers keep track of and manage their personal finances.

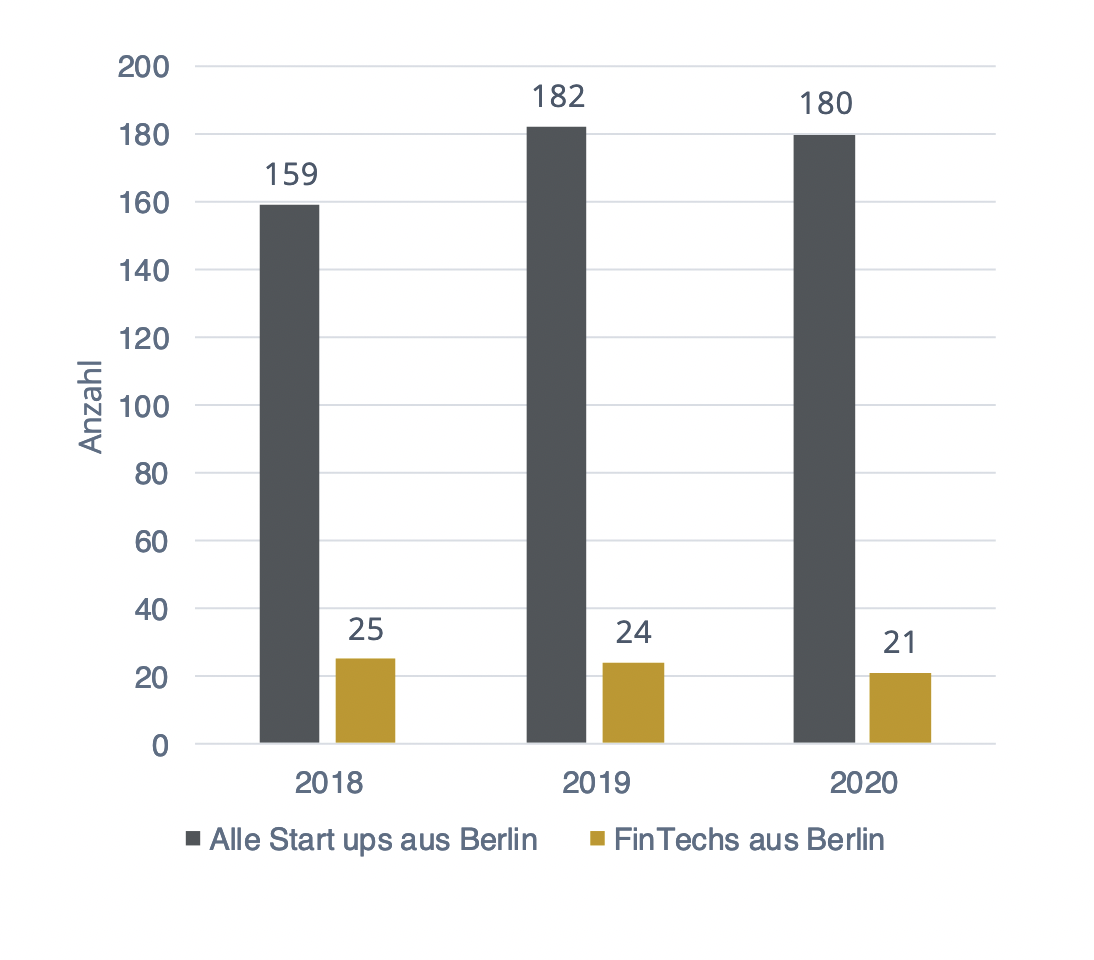

With a share of 28 percent, the startup metropolis of Berlin is home to the most fintechs in Germany. The focus of established fintechs there is on asset management & investment. Young fintechs, on the other hand, are more active in banking & API banking. They market their banking license and provide banking-as-a-service services to their customers. At the same time, the capital also attracts a disproportionate amount of media attention. About 50 percent of startup-related media coverage of fintechs is about companies based there.

According to the German Fintech Report, young fintechs are currently mainly attracted to Hamburg. The Hanseatic city has the largest share of fintechs that are less than five years old, at 61 percent. This new generation is focusing in particular on the new “Defi” focus – decentralized financial services based on blockchain technology.

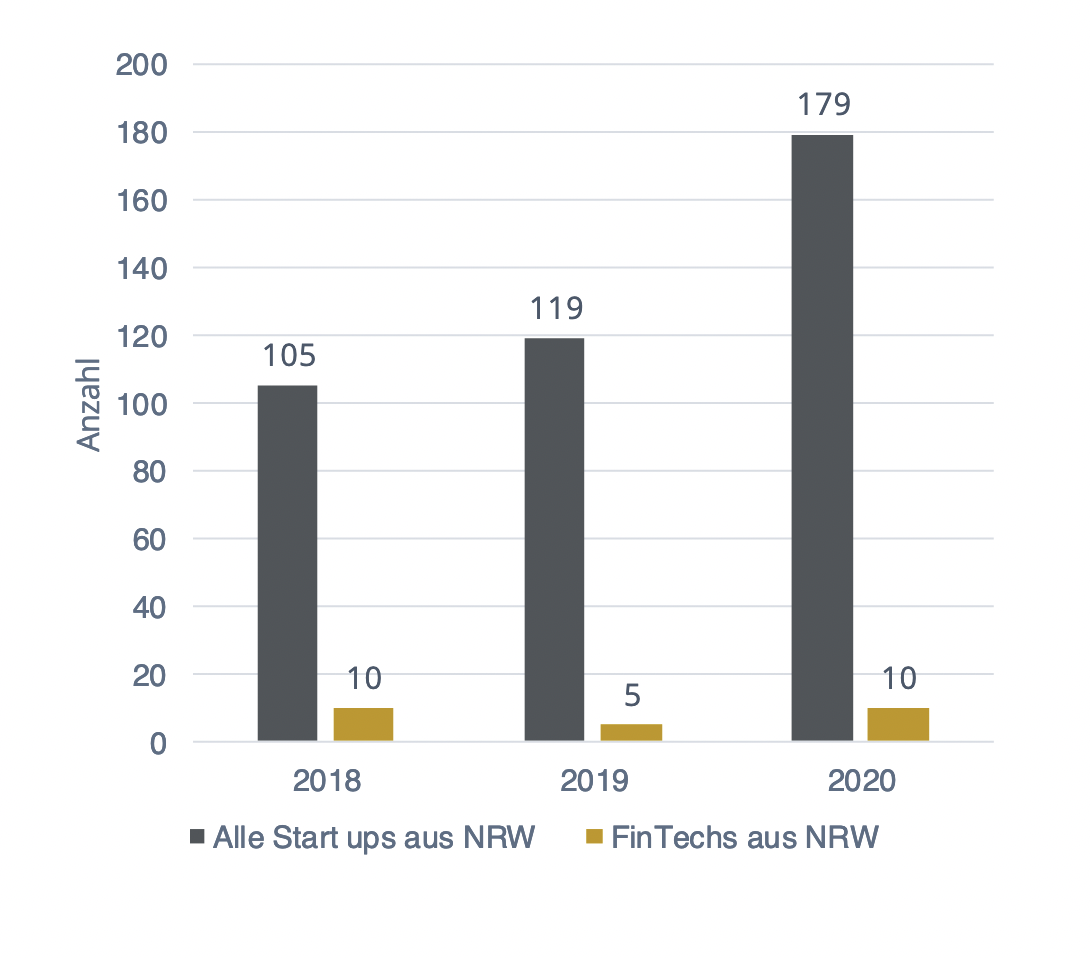

In North Rhine-Westphalia, a distinct cluster can be observed in the area of personal financial management – with both established and young fintechs. However, this cluster has hardly been noticed so far: In the reporting of media close to start-ups, almost exclusively young North Rhine-Westphalian fintechs from the field of asset management & investment are mentioned.

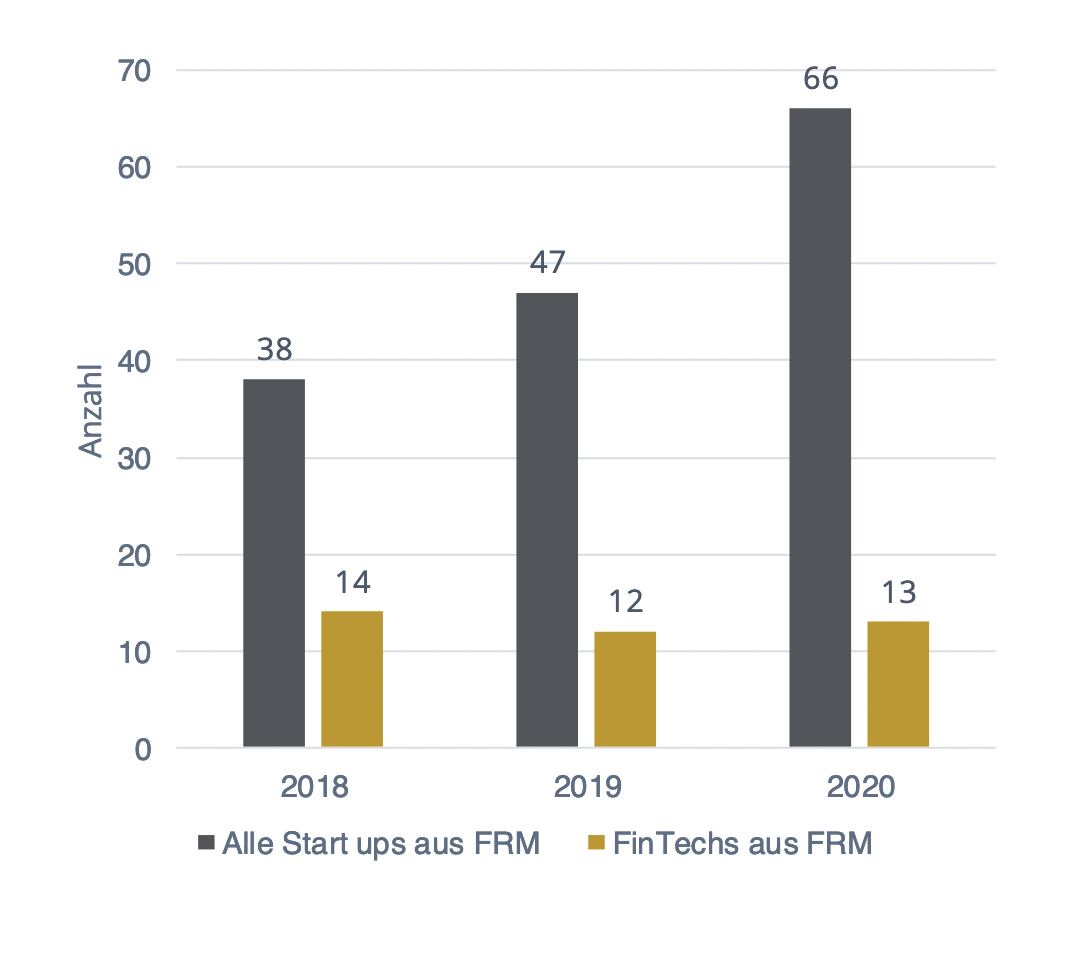

In the Rhine-Main region, young fintechs focus primarily on credit & factoring. This is also the area where by far the most early-stage financing rounds take place. Otherwise, fintechs in the Rhine-Main area also focus on asset management & investment.

Despite all the diversity among the fintechs and the regional hubs, the German Fintech Report also reveals a common trend: the largest group among the fintechs are single-service providers.

With 230 companies, they account for around 36 percent of fintechs. These fintechs deal with one specific product and are not active in several business areas at the same time. This is particularly evident in the Asset Management & Investment division. But also in the area of credit & factoring, the fintech scene is increasingly focusing on breaking down the classic bancassurance provider into different offerings.

The German Fintech Report 2021 is available for download here:

Startbase’s underlying data on the German fintech ecosystem is available here:

About GERMANY FINANCE

GERMANY FINANCE is an informal association of German financial centre initiatives from Berlin, Frankfurt, Hamburg, North Rhine-Westphalia and Stuttgart. The common goal is to strengthen Germany as a financial centre in the German, European and international context, to give it a face and to be the point of contact for interested parties in Germany as a financial centre, both at home and abroad. More about the consortium at www.germany-finance.com.

Active members of the working group:

- Frankfurt Main Finance e.V.

- Hamburg Financial Centre e.V.

- Fin.Connect.NRW

- Stuttgart Financial – Vereinigung Baden-Württembergische Wertpapierbörse e.V.

- Berlin Finance Initiative – East German Bankers Association e.V.

- Other financial center organizations:

- Munich Financial Centre Initiative (with observer status)