-

Influencer marketing in the financial industry

Two marketing surveys published a few months ago by the German Digital Economy Association and the Influencer Marketing Hub clearly show: activating one’s own target group through influencer marketing as…

-

Why the next generation of neobanks must be niche banks

A guest article by Leif Wienecke, Managing Director Digital Banking & Cards at Solarisbank When the first neobanks hit the market in the early 2010s, their core customer promise was…

-

On the track of digitalization!

instant messages #15 by Marcus W. Mosen Marcus W. Mosen comments on payment or banking topics on various portals and delights his followers on twitter (@mwmosen) with pointed contributions on…

-

Programmable payments and the role of DLT

Distributed ledger technology (DLT) will permanently change some industries. Thanks to its property as a decentralized, tamper- and censorship-resistant database, DLT contributes to generating new business models, increasing process efficiencies…

-

2020: High-speed digitization for financial institutions and FinTechs

Digital transformation has long been a central topic in the economy. Financial institutions have also been planning and implementing increased digitalisation for a number of years. However, the Corona crisis…

-

Smart POS systems: entry into digitalization for SMEs

A guest article by Markus Bernhart (ready2order, CEO) Small and medium-sized enterprises are the backbone of the German economy. In no other major economic nation is the share of this…

-

The digital euro as the basis for the digitisation of the economy

Facebook positions itself as a financial services provider There is currently a lot of movement in payment traffic, not only due to the increased volumes of cashless payments triggered by…

-

Liken, Posten, Teilen. Neobanks are much more than just banking!

The theory is actually quite simple: you achieve economic growth and the spread of your brand awareness by tailoring your product to the needs of your target group. If you…

-

Banking-Trends: Diese digitalen Lösungen und Technologien verändern die Finanzbranche

Wie kaum etwas zuvor verändert die voranschreitende Digitalisierung die Spielregeln im Bankensektor. Aufgrund der heutigen Möglichkeiten, seine Bankgeschäfte jederzeit, ortsunabhängig und stark personalisiert vorzunehmen, haben sich die Kundenerwartungen an Banking-Produkte…

-

From energy to AI: The future industrial sectors with growth potential

Last spring the economic news paper Financial times published their annual listing “1000 Europe´s Fastest Growing Companies”. When taking a closer look at the 2019-ranking, the fastest growing companies enable…

-

The Future of Banking

The journey from unbundling to rebundling and back has been a formidable one. Emerging technologies and the pace of innovation are driving changes throughout the banking industry at an unprecedented…

-

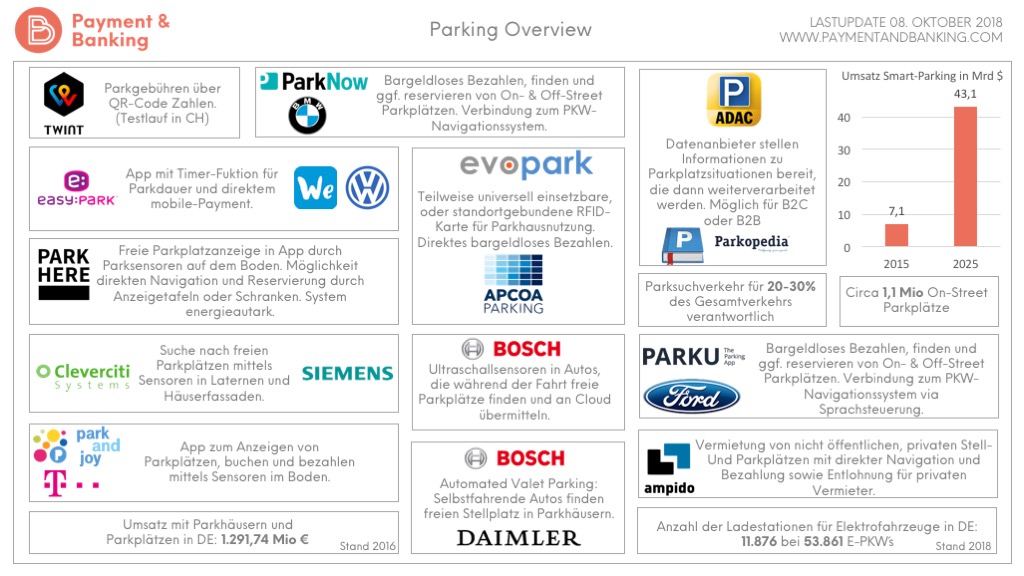

Parking and payment

Will parking now become smart? When people deal with the organized standstill of passenger cars, it sounds terribly boring at first, but what all actually is linked to parking and…

Digitalisierung

-

Influencer marketing in the financial industry

Two marketing surveys published a few months ago by the German Digital Economy Association and the Influencer Marketing Hub clearly show: activating one’s own target group through influencer marketing as…

-

Why the next generation of neobanks must be niche banks

A guest article by Leif Wienecke, Managing Director Digital Banking & Cards at Solarisbank When the first neobanks hit the market in the early 2010s, their core customer promise was…

-

On the track of digitalization!

instant messages #15 by Marcus W. Mosen Marcus W. Mosen comments on payment or banking topics on various portals and delights his followers on twitter (@mwmosen) with pointed contributions on…

-

Programmable payments and the role of DLT

Distributed ledger technology (DLT) will permanently change some industries. Thanks to its property as a decentralized, tamper- and censorship-resistant database, DLT contributes to generating new business models, increasing process efficiencies…

-

2020: High-speed digitization for financial institutions and FinTechs

Digital transformation has long been a central topic in the economy. Financial institutions have also been planning and implementing increased digitalisation for a number of years. However, the Corona crisis…

-

Smart POS systems: entry into digitalization for SMEs

A guest article by Markus Bernhart (ready2order, CEO) Small and medium-sized enterprises are the backbone of the German economy. In no other major economic nation is the share of this…

-

The digital euro as the basis for the digitisation of the economy

Facebook positions itself as a financial services provider There is currently a lot of movement in payment traffic, not only due to the increased volumes of cashless payments triggered by…

-

Banking-Trends: Diese digitalen Lösungen und Technologien verändern die Finanzbranche

Wie kaum etwas zuvor verändert die voranschreitende Digitalisierung die Spielregeln im Bankensektor. Aufgrund der heutigen Möglichkeiten, seine Bankgeschäfte jederzeit, ortsunabhängig und stark personalisiert vorzunehmen, haben sich die Kundenerwartungen an Banking-Produkte…

-

From energy to AI: The future industrial sectors with growth potential

Last spring the economic news paper Financial times published their annual listing “1000 Europe´s Fastest Growing Companies”. When taking a closer look at the 2019-ranking, the fastest growing companies enable…

-

The Future of Banking

The journey from unbundling to rebundling and back has been a formidable one. Emerging technologies and the pace of innovation are driving changes throughout the banking industry at an unprecedented…

-

Parking and payment

Will parking now become smart? When people deal with the organized standstill of passenger cars, it sounds terribly boring at first, but what all actually is linked to parking and…

Trending

Sponsoren und Partner

Schleichwerbung

Der beste Newsletter ever

Mit dem Payment & Banking-Newsletter versorgen wir dich täglich mit News, ausgewählten Artikeln und Kommentaren zu aktuellen Themen, die die Finanz-Branche bewegen. Meld Dich an!