A guest article by Steffen Blümm from adorsys

Finance is an important part of our daily life. It is about our daily needs for living, food, leisure time, as well as education budget for our children, investments and retirement provisions. So finances are actually too important to be handled exclusively by computer or smartphone. Speech Assistant based Devices make banking via smartphone and computer-based online banking and thus enable a larger group of users to manage their finances flexibly;

At the adorsys At the end of 2016 we started a research project dealing with voice banking, which we later named VoiceBank. The aim was not only to make classic online banking information accessible via voice. We were aware from the very beginning that we had to rethink not only the information architecture, but also the services themselves.

Furthermore, we were aware that we were operating much more in the area of conflict between comfort and data protection than with conventional technologies. To simplify processes, we need to learn more about the lives of our users in order to better support them. To do this, we have to create a basis of trust through prudent interaction.

Ubiquitous computing or ambient computing

Ubiquitous Computing (UbiComp) describes the interaction with computers in a way in which the services and computing units in the background are omnipresent. They no longer come to the fore in the form of dedicated devices such as smartphones or computers, but integrate themselves into the room. This is why we also speak of ambient computing. Interaction is thus no longer complicated by unnatural abstractions, but integrates itself transparently into the environment.

„In the twenty-first century the technology revolution will move into the everyday, the small and the invisible.“ (M. D. Weiser)

From computers, smartphones and smart watches, to smart speakers and smart homes – in this form, we have an ever greater adaptation to the existing and the technology integrates itself ever more unobtrusively. While the difference between a classic mobile phone and a smartphone was still relatively large (touch screen vs. keyboard), the differences between smart-watches and conventional watches are smaller. Voice-activated smart speakers go so far that the visible user interface on the device is reduced to a status display. Given an intuitive interaction design, we are entering the realm of ubiquitous computing. Certainly, speech recognition must become even more secure, comfortable and natural. But then, for many people, the hurdles for interaction are minimal.

Inclusive Design – Accessibility for a larger clientele

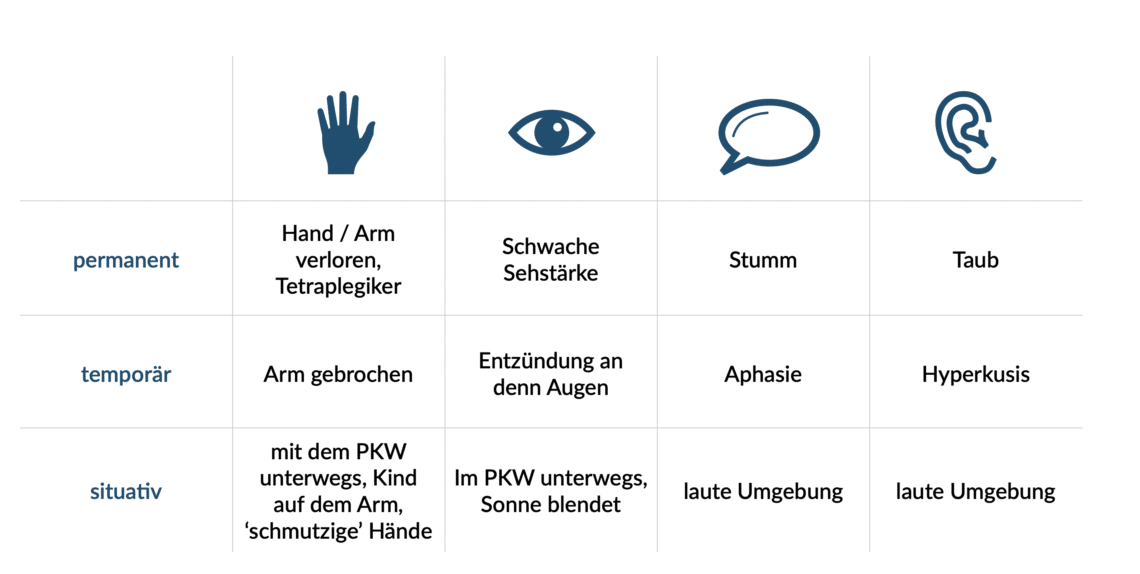

Technology with graphical interfaces has made it possible to greatly increase the usability of services. However, it still has many requirements: the user must be able to see well, often interact with both hands, as well as read and often write. We can speak here of physical requirements (accessibility), as well as developmental and cultural requirements for the user.

In terms of physical requirements, potential users may experience permanent, temporary or situational constraints. For example, a user temporarily cannot freely control the interaction with his hands because he has broken his arm. Another user is only unable to do this situational, because he is holding a small child in his arm or is travelling by car.

In addition, not everyone can read and write. It also happens that our knowledge of a language allows us to speak and understand to a certain extent in oral communication, but reading and writing are not sufficiently mastered. This is particularly true when we think of languages in which writing is fundamentally different from that of the native culture – Japanese, for example. In this case, voice-controlled user interfaces can simplify or enable interaction.

Furthermore, people who are inexperienced with technology, such as the elderly, will have easier access to digital services. Both in Stuttgart and in other countries, good experiences have been made with voice-controlled assistants (robots and virtual assistants) in connection with elderly people. Unfortunately, it is often easier to celebrate ageism than to step out with a prototype and evaluate concepts.

Inclusive design therefore means excluding fewer people by offering several modalities and thus interaction possibilities that can be better integrated into the life circumstances and situations of the users. Voice-controlled, multimodal devices can play an important role in this.

Multimodality

User interfaces with different modalities allow the processing of different data with different cognitive loads. Certain data can be collected and processed more visually effective, others more auditively. Multimodal user interfaces such as Alexa, Siri or Google Assistant on screen-based devices can provide a balanced interaction. By combining visual and auditory output, as well as speech and gesture controlled input, information can be optimally transmitted to the user.

We need to think more carefully about what information is relevant to the user in which situations and how we can optimise the presentation. Responsive design allows surfaces to scale. But instead of using techniques to position information on interfaces in a customized way, we want to provide only information relevant to the user. The more personal information we have about the user, the more we have to consider the tension between comfort and privacy. Relevance is the best way to be trustworthy on the road.

qualitative banking

When we look at banking experiences today, they seem to be based on a very narrow mental model. For people who like to study columns of numbers, they are certainly interesting. The Banking Experience from the 80s of the last century in the last millennium is presented digitally.

Instead of going through the account statement on paper, we can retrieve it digitally. Sure, there are use cases for this, but is this the primary experience we want in interacting with our bank and finances?

This quantitative experience can be contrasted with a qualitative one based on relevance: To know if my salary has already been received, I don’t need a list of payment transactions, and I don’t even need the amount of money. A simple yes or no is sufficient. To know whether my equity fund has performed well, I don’t need absolute figures, maybe I don’t even need relative figures. Again, a simple qualitative answer might be sufficient.

Capital One found that many users asked for qualitative information when evaluating usage behavior with their Alexa-based banking assistant. Customers asked if everything was ok; if the developments on the current account or stock portfolio were positive. At least people always want to study the exact figures, they just want to have a good feeling.

Voice banking benefits from qualitative approaches in several dimensions. Qualitative banking enables us to provide users with relevant information without having to disclose personal data. The voice assistant does not have to tell me how much my salary is, only that it has been received. It does not have to tell me how much money I have in my account, just that no conspicuous or unexpected bookings were found. For details I can later, in a quiet moment, still sit at my computer and study booking lists.

Non-transmitted data can also not compromise the privacy of the user.

Another advantage of Conversational Banking is speed. Voice control can help to speed up processes. At US Bank, the customer can use voice input to carry out a transaction with one sentence. Sure, to do this, the systems (APIs and integrations) must be available, but a transfer can be done faster than a computer connects to the online banking portal or the user has found the app on the smartphone. For US Bank customers, voice control also makes the service’s functional range more intuitively available. Functionalities are found by more users than when navigating through menu branches in GUI-based user interfaces.

The VoiceBank Project

As already mentioned, in this research project we have set out to rethink processes. We have considered where we can help our users with qualitative information. In this way, we maintain confidentiality, regardless of the situation the customer is in and regardless of the platform provider (Amazon, Google or Apple). Furthermore, we use concepts that are not yet used in banking, but are used by modern payment service providers: bank transfer contacts.

These can be created by the user or the system can learn them. In addition, the system should also have the ability to communicate with the user in a confidential manner – for example, by whispering, changing the modality (visual output only) or channel (push notification to the customer’s smartphone). US Bank has implemented a similar concept for its voice assistant.

“ User contacts can be created by the user or the system learns them.

With the help of our CUI Prototyping Tools we were able to open usability tests To make this task easy for the test persons – to ask the banking assistant to communicate with them confidentially Here it was practically possible for us to find out directly from the user what he or she has in mind.

Another point we looked at closely was authentication. How can we authenticate the user? Voice recognition is not secure enough, there are too many ways to gain access nevertheless. A PIN, which the user has to say, was also not secure enough for us. We can’t always make sure that nobody is listening to us.

But we were sure that all users of our Conversational Banking Assistant also use a smartphone. So we decided to set up a system in which the Banking Assistant sends a push message to the corresponding app on the smartphone so that the user can authenticate himself with fingerprints or face recognition. After successful authentication, the app releases the session. Qualitative information could thus be retrieved without having to authenticate. For more detailed information, the user must briefly reach for his smartphone. If he wants to make a bank transfer, he needs this anyway. In this case, the user can simply tell the assistant the TAN, as it is only valid once and therefore security is not compromised.

The Picture Passcode is another method of authorization. We have recently designed and tested this. This is a visual password that can be used in situations where a smartphone cannot be used. We developed it in the context Driving tested on a prototype. However, it is also conceivable to evaluate it in other situations where contactless numbers are desired.

Nevertheless, modern banking experiences are not only characterized by well thought-out user interfaces that can be used in different situations. The entire service must be stable and reliable. The challenges increase with the number of third-party services that have to be integrated and which bring more profit for the user. For modern banking experiences, these are very many.

Through the availability of multibanking solutions such as the open banking gateway of the adorsys, PSD2-based access to account data can be quickly connected. With the ModelBank new banking experiences can be designed relatively easily and later put into operation with the Open Banking Gateway. This allows more attention to be paid to the processes and the experience.

conversational banking

Conversational banking can speed up many processes for the user and facilitate the retrieval of financial information in many situations. Especially when the qualitative dimension of information is taken into account in addition to multimodality and inclusive design. Qualitative banking can often provide the customer with enough information without having data protection implications. The possibilities for a new banking experience are many and varied. We can bring real relief to the lives of our customers.

At adorsys we make complex technologies intuitively accessible. In our interdisciplinary project teams there is always a lively and regular exchange between designers and developers to create a positive experience for the end user. Please visit our websiteso that we can also design and develop the optimal software product for your user group under UX/UI consideration.

To read and listen

https://paymentandbanking.com//www.vs.inf.ethz.ch/publ/papers/UbicompLogin.pdf

https://www.ics.uci.edu/~corps/phaseii/Weiser-Computer21stCentury-SciAm.pdf

https://ubiquity.acm.org/article.cfm?id=985617

Richard Weeks, Head of Conversational Experiences at US Bank, Voicebot Podcast Ep 165