instant messages #18 by Marcus W. Mosen

Marcus W. Mosen comments on payment or banking topics on various portals and delights his followers on twitter (@mwmosen) with pointed contributions on payment, fintech or politics. From now on you will find his monthly guest column “instant messages by…” on the latest happenings in payment, banking & co.

Dare to make more progress – that’s an interesting slogan for a coalition agreement, which the coalition partners have come up with. The verb “to dare” is connected in my biography with the title of a book which appeared in 1993 under the title “Treuhandanstalt – das Unmögliche wagen” (“Treuhandanstalt – Dare the Impossible“), and which I was privileged to help write at the time. The then Treuhand task of privatising, rehabilitating and (unfortunately also) winding up East German companies was in many areas a procedure for which there were no instructions.

Progress is a matter of course nowadays

And then as now, nothing ventured, nothing gained. Daring to do something “impossible” sounds paradoxical, but against the background of what was necessary at the time, it was consistent, time-critical and thus logical. The combination “dare to progress” rather triggers the association of procrastination for me. After all, progress has been taken for granted in our society since the Age of Enlightenment. However, the idea of progress is always linked to ideologies. We have known this since Kant, who already at that time stated that “progress for the better is not secured by any theory, but is alone a postulate of practical reason.” (cf. Kant’s Theory of History, M. Merseburger, ZfPT, 2/2011)

In common parlance we do not usually distinguish between the terms venture, risk, danger or adventure. It will therefore be interesting to follow in which consequence an implementation of the treaty will lead to more social value gain or sense making or to more sacrifices (levies, taxes, inflation) or restrictions (regulation, specifications, regimentation).

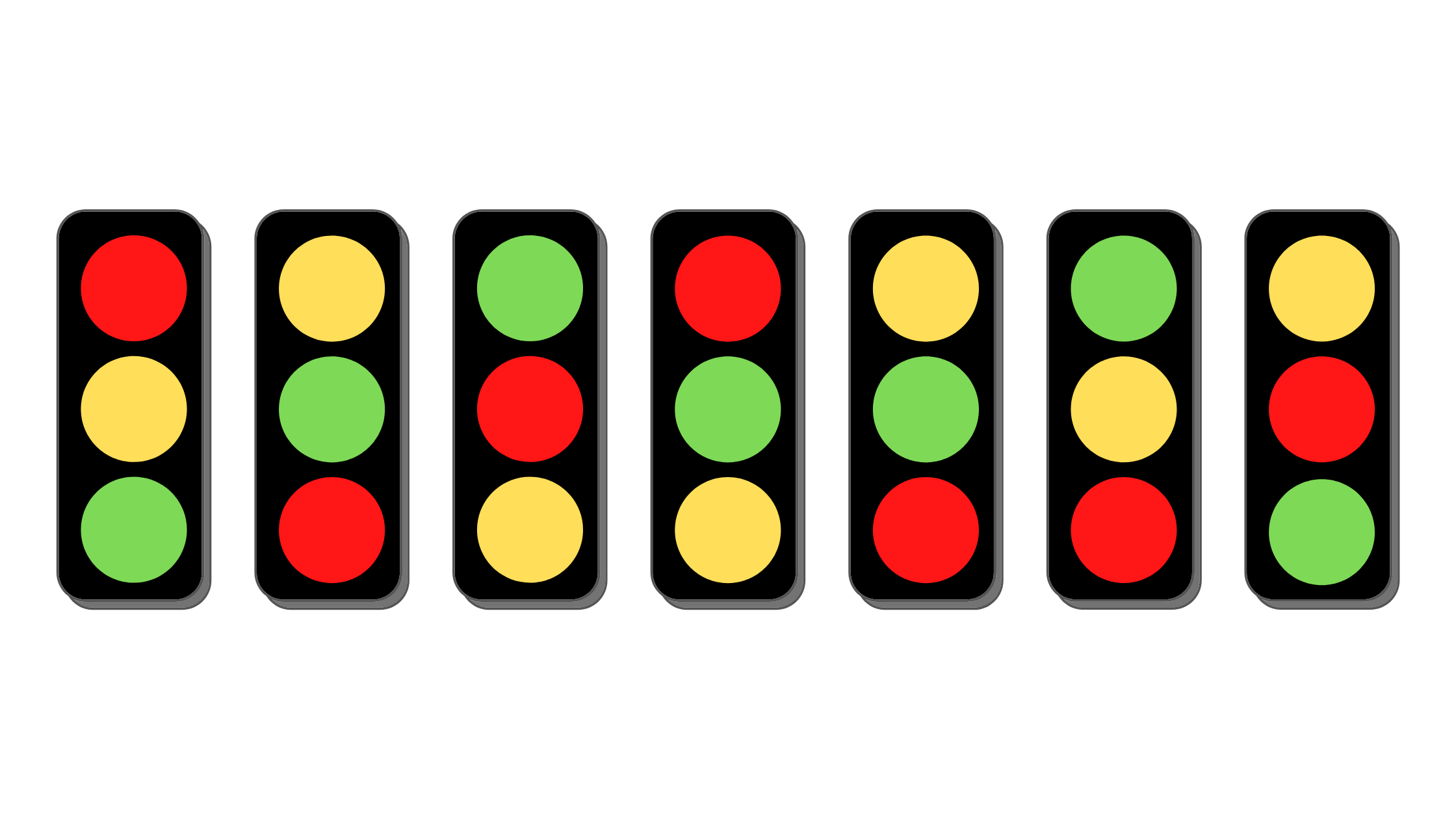

From the point of view of the payment and fintech industry, what kind of ventures can we expect from this coalition agreement of the traffic light coalition? Let’s take a look at the contract!

Framework conditions for level playing field must be right

The preamble states: “The world is changing at the beginning of a decade, so we cannot remain at a standstill. Beautifully formulated, but at least the established payment and banking community has already been in upheaval for at least a decade. The advancing digitalization of the industry promotes and challenges the traditional structures and processes in the provision of financial services products, as well as, in large part, the retailer’s understanding of service. Against this backdrop, the last decade has seen the emergence of a large number of e-commerce and fintech companies that are not standing still. And when it is stated further down in the coalition agreement that our “prosperity in globalisation” is closely linked to the fact that we (in Germany) “continue to play in the top league economically and technologically and develop the innovative strengths of our economy”, then I see these driving forces and capabilities primarily in the new players in our industry.

If the term “international system competition” is used in the coalition agreement of the “traffic light” coalition, then the coalition partners should be aware that Germany will only play a role in the payment and banking of tomorrow if the framework conditions for a level playing field are created, at least in the European Union. This insight of the traffic light can be derived from the fact that the desired digital awakening will only succeed “within a progressive European framework” (p. 15). We can therefore be curious to see whether the radiant power of the traffic lights will also have an effect on our neighbouring countries.

Traffic light coalition should dare to get closer to fintechs

From a payments perspective, it is remarkable that the coalition has chosen as an industry particularly worthy of support a segment with which the former Wirecard, among others, generated its early “fundings” itself. Under the heading “Digital Economy” we find the sentence: “We are strengthening Germany as a location for games and making funding more permanent. (page 19). Obviously, the lobbying associations of the gaming industry were at their best during the coalition talks. Let’s hope the government dares to extend its ambitious goals for the tech hub to other tech industries in a more pointed way.

On page 166, in the paragraph on “combating tax evasion and tax avoidance”, we find that “aggressive tax avoidance” is to be pursued and prevented with “the greatest possible consistency”. There is a very simple solution here: a legal obligation for retailers and restaurants to accept digital payment! This not only brings customer orientation at the POS abruptly to the forefront, but also creates tax honesty in the blink of an eye through mandatory card acceptance. The side effect for the cash register operators and payment service providers is not a “steady promotion”, but at least a one-time supporting marketing initiative.

The associations of the three banking groups in Germany have traditionally maintained a close exchange with all democratic parties. It is not really surprising that the “three-pillar model” in the coalition agreement is thus placed under monumental protection (p. 168). The new “fourth pillar” – the fintechs, InsurTechs, platforms and neo-brokers – has been assigned the role of “idea generator” by the traffic light. That is certainly well-intentioned, but in no way does justice to the strategic role and relevance of these new companies in the venture legislation period ahead of us.

But maybe the knowledge level of many Ampelians is still too much connected to the former most important (wrongly called fintech) “high risk banking institution” in Aschheim?! So I definitely recommend the traffic light to venture a little closer – to the new fintech players in our republic.

Politics as a tactical observer

The EPI project has also made it into the traffic light agreement, at least with the sentence “Europe also needs an independent payment traffic infrastructure and open interfaces for barrier-free access to digital financial services for all consumers and traders”. The term “accessible” is surely a dig at Apple and its NFC interface. However, bringing this into a close, causal relationship with EPI also shows that the authors of the traffic light coalition have not fully penetrated the overall context in digital payment or are trying to simplify it. Who can blame them?

The fact that in the meantime only bank groups of 2-3 countries are backing EPI’s upcoming financing round will present the shareholders with the challenge of “reducing” the positioning to more of an innovative payment platform that, if successful, other banks or countries can join. This would then have to be done in a market-based rather than a payment infrastructure approach. Maybe the “Christ Child” still has a surprise in store…. Politicians will remain more of a tactical observer, because at least for e-mobility charging stations, traditional payment solutions seem to be more than adequate.

Traffic light coalition has not yet exhausted all possibilities

From the perspective of the payment and fintech industry, the coalition agreement falls far short of its possibilities and opportunities. Payment – whether digital or cash – plays an essential role in all existing and new business models. A “constructive accompaniment” (p. 172) of the introduction of the digital euro (as a supplement to cash) does not sound like daring to make progress, but rather like hesitantly waiting for what is yet to come. Also on the “need for a new dynamism in the face of the opportunities and risks arising from new financial innovations, cryptoassets and business models” (p. 172), the industry asks what this might entail. The Greek adjective “dynamiké” stands for “powerful” and “force”. A little more dynamism, not only “needed”, but also driven forward in a committed manner, would certainly be a good thing for politics and also for one or the other part of the payment and banking ecosystem.

In any case, the new traffic light coalition is to be wished more courage and openness with regard to the payment and fintech industry. Because the necessary transformation – and not just progress – can only be achieved when the impossible is dared. Because nothing is impossible!

Photo credit “Kant”: Copyright: imageBROKER/GabrielexThielmann iblgth05090646.jpg