Our “FinTech of the Year 2019” – Trade Republic has announced a new impressive funding round with Accel and Founders Fund! Congratulations to Berlin.

In podcast 203, the colleagues gave a good outlook on what they are doing. In general, we have been following the topic for a long time, as Trade Republic was a winning team of one of the first “figo Bankathons” and afterwards, as a prize from winning the Challenge, took a place in the start-up garage of comdirect (https://www.gruenderszene.de/allgemein/bankathon-offenbach-2015).

The podcast above was before the penultimate funding round, in which Project A and Creandum joined as investors. In retrospect, this round and the following Business-Angel round with prominent investors can be described as signaling, as Accel and the Thielschen Founders Fund are now at least in the same league as international VCs investing in Trade Republic in the middle of the crisis.

What does the Paymentandbanking team say? Do we ourselves use the winners of our prizes?

I wanted to know from the team who is a user of Trade Republic and what possible experiences there are.

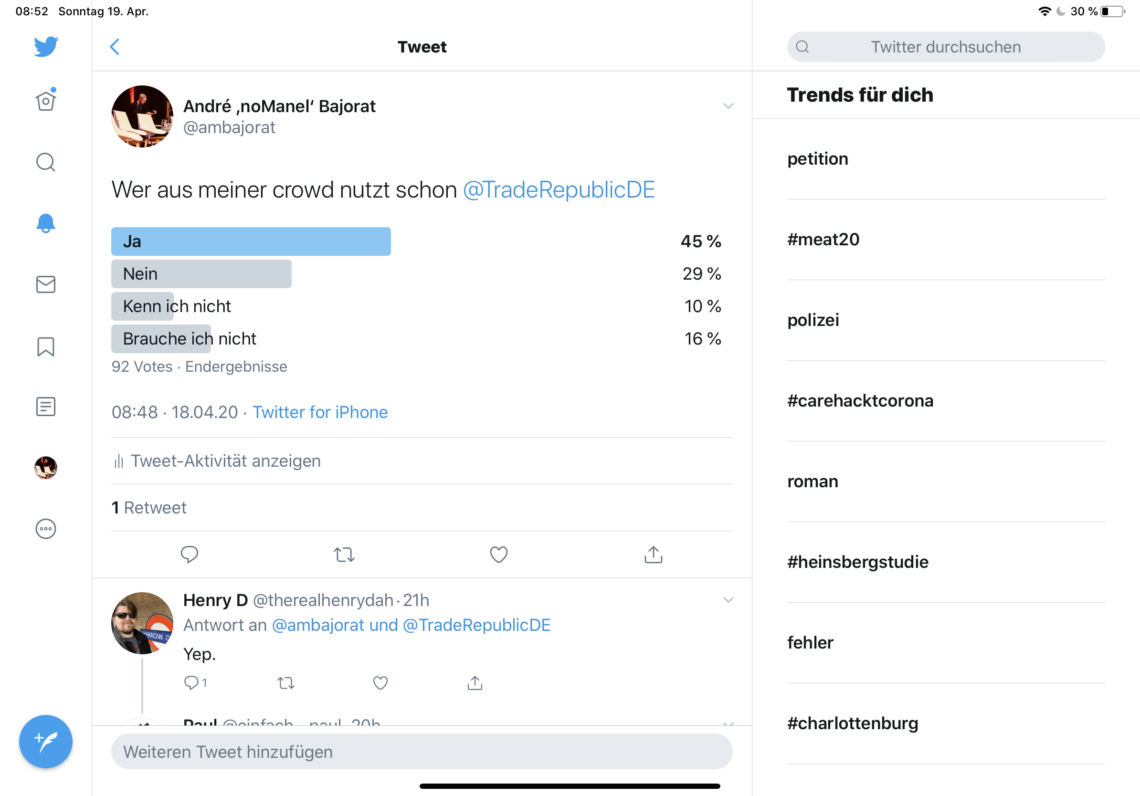

At the same time, I also asked the question of my filter bubble on Twitter and exciting 45% from this round are already users and only 16% see no need for themselves to give Trade Republic a chance.

Kilian Thalhammer

I’m not a user yet but rather because I haven’t devoted any time to stock trading since the first phase of online brokers – DAB and Consors send their regards. Even if “gambling” is fun, especially if you have time (and some money).

But the target group does not seem to target Trade Republic, they are more conservative and “reasonable”. I am curious what has happened since then.Irrespective of my personal experience, respect to complete such a round in this size is not easy and therefore all the more substantial. Even on the part of the investors: Funding under uncertainty requires courage and backbone.

Jochen Siegert

I am not a really big trader and since the end of the 90s I have spread my share purchases/savings plans over several accounts with the usual direct brokers. This all actually screams for consolidation and I’ve been with Trade Republic from the beginning and have been testing a bit. If I compare a mundane buy or sell, the differences to the direct brokers with their GREY TAN/SCA app arias are dramatically different – the PSD2 has also made things worse there instead of more convenience from the customer’s point of view.

Trade Republic is soooo much easier to use in direct comparison, apart from the much cheaper price of the trade. Congratulations to the team and keep up the good work! 20-25 years after the great innovation by the direct brokers there is finally a serious challenger again! That’s good!

Maik Klotz

Not a user, but always close to becoming one. From an end-user perspective, brokering still has something to do with gambling for me. Although Trade Republic is not that, a solution for gamblers. Nevertheless, the website and solution doesn’t feel 100% targeted to the masses. So, I like the Swedish Fintech Dreams a bit better. But: that’s “tastes” and Trade Republic deserves the price, because they broke up a bulky market. And the good thing is: that there are certainly many great ideas for the expansion of Trade Republic. And the success and this mega-investment prove the Berlin Fintech right. Respect and congratulations!

Christina Cassala

Hats off! In times like these, collecting so much money seems to be a really good business. I am not a user (yet). I should change that. Trade Republic tries to make stock trading accessible for everyone with just a few clicks. With this offer they seem to reach even a broader mass in view of the reported user numbers. However, the topic of “stock trading” still has the aftertaste of being only something for the higher earners. This is nonsense, of course, but the Berlin trading app will have to continue working to break down this cliché.

The easier the product is to understand, the easier it becomes for the founders. If they succeed, Trade Republic has the chance to address many new target groups.Congratulations from my side as well: Trade Republic is one of a number of German Fintechs that have attracted worldwide attention from investors. More of them! This is another important signal for Germany as a business location.

André M. Bajorat

I myself have been a user from the very beginning and can simply say that I don’t want to miss the experience anymore. The thought of getting to the result with only three clicks is just great!

So far, I miss little (children’s deposit and simpler settlement against the current account would be good and in the sense of spontaneous purchases – business-enhancing!) and I have both the deposit transfer completed (unfortunately, in fact, not all papers were possible) and also immediately set up a savings plan (yes, not only monthly possible!) than it became possible some time ago.

Conclusion

It’s great to see that with Trade Republic we see a player from Germany who really has a great potential and where you can see that a good and convinced team with a lot of ambition and vision can reach the goal even via detours. Congratulations also to the partners behind the team: Solaris, sino and lang & schwarz. It seems that the investment solutions made in Germany are also welcome worldwide: Raisin, elinvar, Zinspilot or Scalable are further successful examples with well-known investors and scaling.