Study on sustainability and pension provision

A guest contribution from Til Small – Founder and managing director of the retirement provision start-up Vantik

A sustainable lifestyle plays an increasingly important role for most of us. Especially since the “Fridays For Future” movement has not only inspired schoolchildren* but also more and more people worldwide to take an interest in climate change and to work for climate protection.

The influence is also noticeable in the finance sector. Over the past few years, new players have appeared on the scene to make traditional financial services not only more digital, but also more sustainable. Because established institutions are finding it difficult to reflect the wishes and needs of their customers in appropriate products, a gap is emerging that Fintechs and Insurtechs know how to fill.

Which few customers are aware of, both here and there: Sustainable investments represent an enormous lever to bring about changes in the sense of climate change and other social challenges. The connection is particularly obvious when it comes to retirement provisions: Who wants to provide for a future worth living in by directly financing arms companies or indirectly clearing rainforests?

Germans consider a wide range of sustainability issues to be relevant

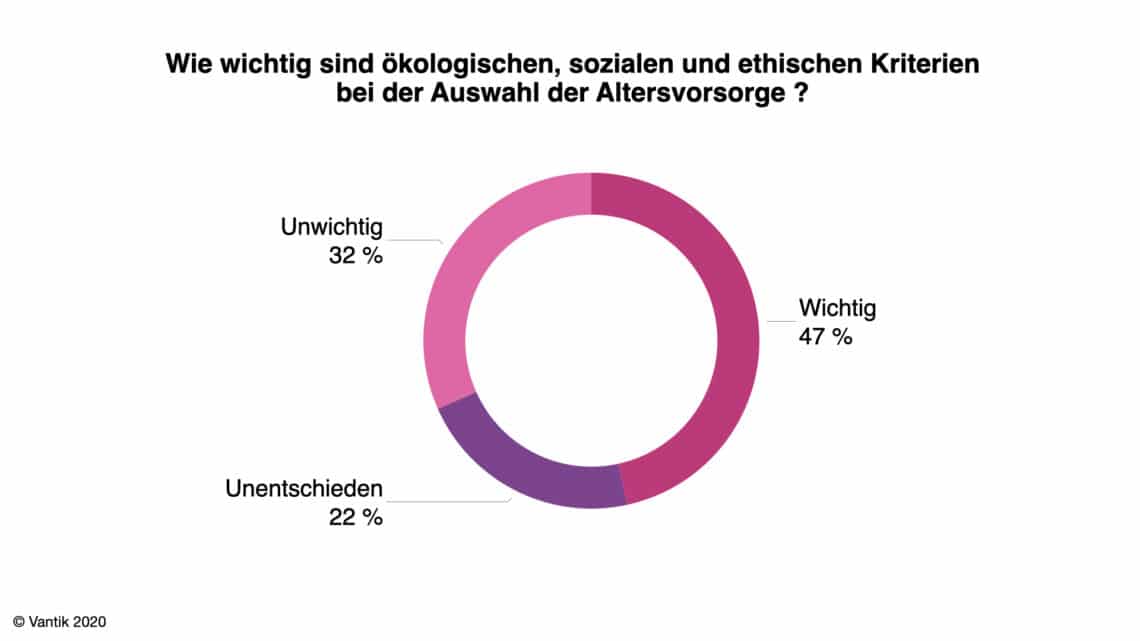

And indeed, according to a representative Studywhich we at Vantik carried out together with the market research company Civey, 48 percent of the German population consider the topic of sustainability in retirement provision to be important or very important.

With regard to the aspects subsumed under the term “sustainability”, it is apparent that a number of sustainability issues are relevant to people with regard to their old-age provision. In particular, climate and environmental protection (for 47.7 percent) and the protection of human rights (for 60 percent) play an important role.

Essentially, this reflects all three categories of the so-called ESG criteria: environmental issues (E = Environment), social issues (S = Social) and supervisory structures (G = Governance). These criteria are already being used sporadically in the financial sector to measure compliance with sustainability standards. However, these criteria are not yet widespread in the area of retirement provision.

Sustainable pension provision: customers complain about a lack of offers and transparency

At the same time, the offers of classic life insurance or other pension products are hardly sustainable and if they are, then they are very, very expensive. This is also something that customers criticize: 41.1 percent of Germans see a lack of suitable products. In addition, a lack of transparency and verifiability on the part of the customers – as 41.4 and 44.2 percent of those surveyed respectively stated – is an obstacle to broad penetration of the topic.

The study also shows that even among those consumers* interested in sustainable old-age provision there is still a great need for information. More than a quarter (26.8 percent) still believe that returns must be sacrificed for sustainable investment products. However, it has long been proven that sustainable investments are in no way inferior to their non-sustainable counterparts in terms of security and returns, and are even superior to them.

What providers should do now

From the study, a number of action points can be derived which should determine the discussion and action of the market players in the future:

- Sustainable pension provision is no longer a niche topic and a large part of the population is paying attention to sustainability – therefore a broader range of products is needed.

- A traffic light labelling for financial and insurance products according to the degree of sustainability – comparable to a categorisation of food according to ingredients – can be an appropriate response to the desire for transparency.

- Above all, suppliers, but also consumer protectors* must educate people about the misconception that sustainability and returns are contradictory.

- Sustainability must not be used solely as a marketing label to justify horrendous costs. For sustainable pension provision to become accessible to a broad mass, price discrimination must stop.

Politics on the move: “Europarente” can bring the breakthrough

Last but not least, it is also up to politicians to promote the issue of sustainability in old-age provision. The EU Commission has launched the European “green deal“A key element of the plan is the European “Green Deal” investment plan, which will provide at least €1 trillion for sustainable investment in the EU over the next decade.

Next year, the Pan-European Personal Pension Product (PEPP) will launch the single market for private pension provision with an expected total volume of EUR 2.1 trillion by 2030. Current plans only provide for a label to indicate whether ESG criteria have been taken into account for a product. If the inclusion of ESG criteria were to be mandatory for all products, this would be a major step towards the goals of the “Green Deal”. And: It would give customers the opportunity to make provisions for their private financial future and at the same time contribute to ensuring that this future takes place in a world worth living in.

About the author:

Til Klein is the founder and managing director of the retirement provision start-up Vantik. Prior to that, he was Partner & Managing Director at Boston Consulting Group (BCG), responsible for retail and private banking in Germany and headed sales development for private and business clients at UBS in Zurich. He is a member of the Council of Experts for the new European pension scheme at the European insurance supervisory authority EIOPA. You can contact the author at [email protected] contact.