Ein Gastbeitrag von CMSPI

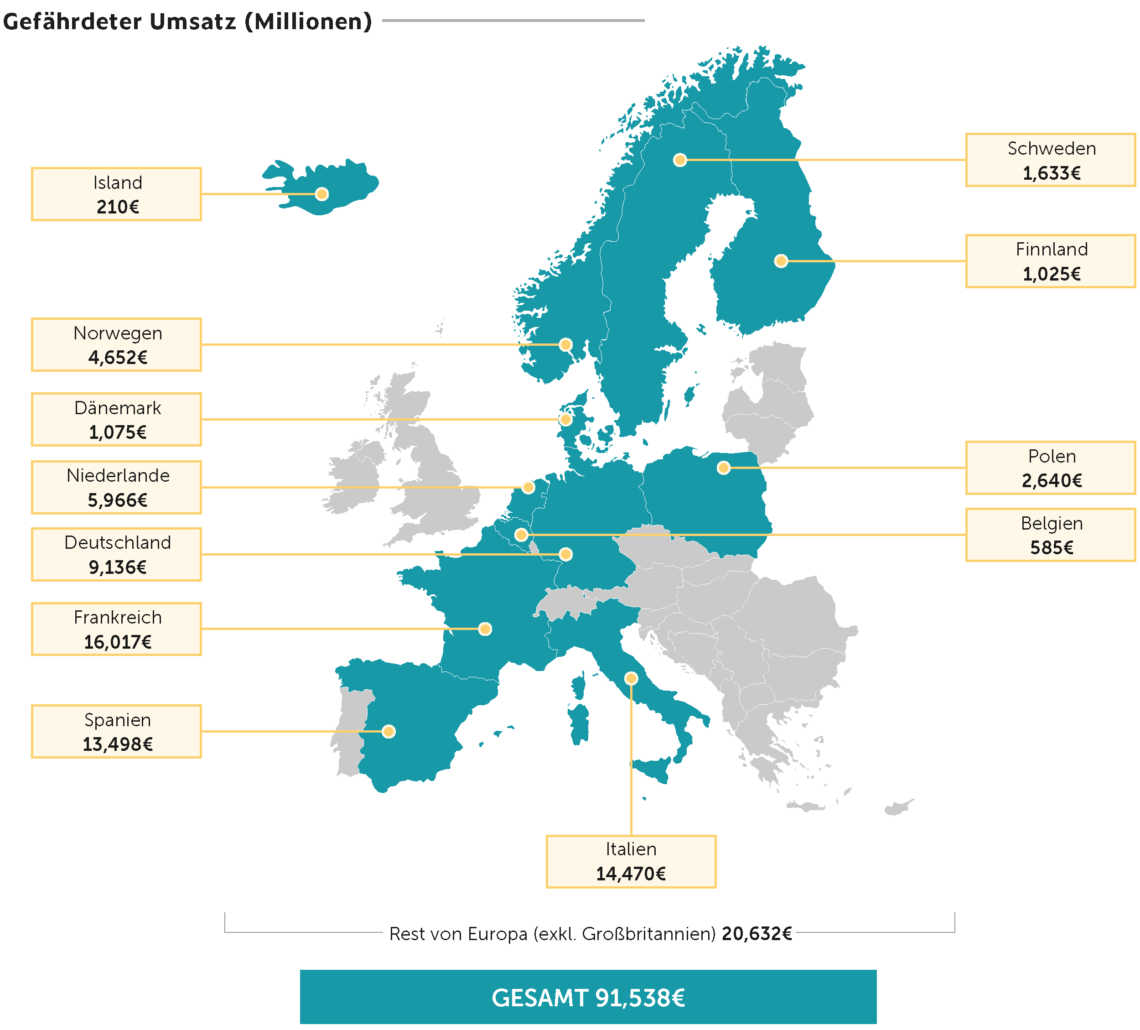

Nach einem krisengeprägten Jahr für europäische Einzelhändler steht der 01. Januar 2021 wie ein Damoklesschwert über dem E-Commerce. Laut CMSPI, einer unabhängigen Payment-Beratung, sind bis zu 91,5 Milliarden € Umsatz in Europa gefährdet, 9,1 Milliarden € davon in Deutschland. Ein Mandat, das den Kredit- und Debitkartenbetrug reduzieren soll, kann verheerende Auswirkungen auf den Handel haben, wenn nicht schnell gehandelt wird – ironischerweise fast das hundertfache des jährlichen Betrags an Kartenbetrug. Die Zahl schließt Transaktionen aus, die mit digitalen Wallets wie Apple Pay oder PayPal getätigt werden, die über eigene SCA-konforme Lösungen verfügen, die deutlich weniger Reibungsverluste im Check-out verursachen.

Starke Kundenauthentifizierung

Ab Januar müssen zahlreiche Issuing-Banken das Mandat zur Starken Kundenauthentifizierung erfüllen. Eine EU-Bankenverordnung, die Online-Zahlungen sicherer machen soll. Hierfür wird die Technologie 3D-Secure Version 2.X genutzt, ein von den vorherrschenden Kartensystemen entwickeltes Authentifizierungsprotokoll, das Händler, die Online-Kartenzahlungen akzeptieren möchten, unterstützen müssen.

Der Kunde muss sich über zwei von drei Identifikationsmethoden – Wissen (z. B. PIN, Passwort), Inhärenz (z. B. Face ID, Fingerabdruck) oder Besitz (z. B. Handy) – identifizieren, damit die Transaktion authentifiziert werden kann.

Verbraucher verbinden Fehler mit dem Händler selbst

Die 3DS 2.X Technologie ist noch relativ neu und unerprobt. Sie bringt erhebliche Reibungsverluste für den Online-Handel mit sich und verlängert Check-out Prozesse laut der Studie von CMSPI um 60 Sekunden bis zwei Minuten, was erhebliche Auswirkungen auf das Kundenerlebnis hat. Tests zeigen, dass 26 Prozent der 3DS2-Transaktionen fehlschlagen, verglichen mit einstelligen Fehlerraten ohne diese Technologie.

Kleine Einzelhändler könnten nicht über genügend Ressourcen zur Prozessoptimierung verfügen und so Umsatzanteile an größere Händler verlieren.

Viele Issuer-Banken in Deutschland sind noch nicht bereit

Die Technologie wird derzeit erst von 60% der deutschen Issuer-Banken überhaupt angeboten und diese Zahl hat sich seit August nicht verbessert. Dies gibt deutschen Einzelhändlern 1,5 Monate vor der Deadline wenig Möglichkeiten für valide Tests. Obwohl deutsche Einzelhändler ihr Bestes geben, die Technologie so schnell und so reibungslos wie möglich einzuführen, kann eine strikte Einführung ab dem 01.01.2021 verheerende Auswirkungen haben.

Verschieben oder nicht verschieben, das ist hier die Frage

Der Handelsverband Deutschland (HDE) fordert in einem Schreiben an die BaFin einen geordneten Übergang zur Starken Kundenauthentifizierung. „Wir müssen die Kunden zunächst an die starke 2-Faktor-Authentifizierung gewöhnen. Der Vorschlag der BaFin nach einer Staffelung nach Betragshöhen in einem Zeitraum von Januar bis März bietet dabei eine gute Grundlage“, so HDE-Zahlungsexperte Binnebößel.

“Wir müssen die Kunden zunächst an die starke 2-Faktor-Authentifizierung gewöhnen.”

„Wenn die gesetzliche Forderung hart ab 1. Januar 2021 greift, gibt es Friktionen, die bislang nicht einschätzbar sind. Kunden wandern zu großen Anbietern ab, wählen eine alternative Zahlart mit höherem Risiko oder verzichten im schlimmsten Fall auf den Einkauf. Bankenaufsicht und Politik haben es in der Hand, die Folgen abzumildern.“

Auf der anderen Seite wirkt es so, als ob die Branche den Druck einer Deadline braucht, um Änderungen durchzusetzen und sich richtig vorzubereiten. „Sowohl als Payment Mensch als auch als Privatperson bin ich ganz klar für SCA und halte rein gar nichs von einer erneuten und weiteren Verschiebung. Es war genug Zeit die Anforderungen umzusetzen.“ André Moeller, Payment Professional. Eine Meinung, die absolut nachvollziehbar ist. Da COVID-19 den Händlern in Deutschland derzeit jedoch alles abverlangt, könnte eine andere Herangehensweise notwendig sein.

Zahlungsexpertin Laura Treude von Douglas würde höchstens eine Verschiebung auf Januar/Februar gutheißen, da die Deadline „sehr nah an der Peak-Saison für Händler liegt“ und damit sich die Warte-Blase endlich auflöse, in der man sich aktuell befände. Erst dann kann eine Optimierung auf Grundlage neuer Erkenntnisse geschehen. Sollte diese Herangehensweise richtig sein? Wäre es nicht viel besser gewesen, wenn Händler bereits im Januar mit einer optimierten Lösung starten könnten und verschiedene Deadlines für verschiedene Akteure in der Zahlungskette gegolten hätten?

Exemptions als der heilige Gral?

Eine Exemption-Strategie, um 3DS2 für bestimmte Transaktionen zu umgehen, wird für das Kundenerlebnis im Check-out und für die Umsätze von E-Commerce Händlern im Jahre 2021 unumgänglich sein:

Transaktionen mit geringem Risiko

Transaktionen mit geringem Risiko sind von SCA ausgenommen. Händler können auf Grundlage eigener Fraud-Bewertungen entscheiden, ob sie Transaktionen mit 3DS authentifizieren, oder diese Ausnahme nutzen möchten.Issuer-Banken haben dann final die Möglichkeit, die Ausnahme zu bestätigen. Weiterhin wird das Risiko-Scoring von Transaktionen auf PSP-Ebene durchgeführt und beruht nicht auf dem Risikoprofil des Händlers selbst.

Dies ist wichtig zu verstehen, da ein Händler von dieser Ausnahme ausgeschlossen werden kann (und als Folge mit höherer Wahrscheinlichkeit Umsatzeinbußen erleiden wird), weil Lieferanten zu konservative Kontrollmechanismen anwenden, um ihre Fraud-Rate möglichst gering zu halten.

Transaktionen mit geringem Wert

Transaktionen unter 30 € sind von Starker Kundenauthentifizierung ausgeschlossen. Ähnlich wie bei kontaktlosen Zahlungen gilt auch hier ein Gesamtlimit: Der Gesamtbetrag darf für diese Ausnahme 100 € innerhalb von 24 Stunden nicht überschreiten und bei jeder 5. Transaktion wird Starke Kundenauthentifizierung gefordert.

Whitelisting

Kunden können Unternehmen bei ihren Issuern whitelisten und zukünftig Starke Kundenauthentifizierung für diese Unternehmen vermeiden.

Abonnements und wiederkehrende Transaktionen

Wiederkehrende Transaktionen mit einem festen Betrag nutzen nur bei der ersten Einrichtung Starke Kundenauthentifizierung. Wenn die Zahlung vom Händler initiiert wird, fällt diese nicht in den Anwendungsbereich von Starker Kundenauthentifizierung, was wiederkehrende Zahlungen auch mit wechselnden Beträgen möglich macht. Die Karte muss jedoch auch hier bei Hinterlegung oder der ersten Zahlung stark authentifiziert werden.

Eine Exemption-Strategie wird für E-Commerce Händler im Kampf um die optimierte Conversion-Rate immer wichtiger werden und ab 2021 die Spreu vom Weizen trennen.

CMSPI Informationen:

Kosten- & Risikoreduktion | Approvals & Fraud | Unabhängigkeit

CMSPI ist die weltweit führende Payment-Beratung für Händler. Unser Expertenteam arbeitet täglich daran, die Retail-Community mit Insights, Expertise, Benchmarking und Analysen zu befähigen, den Wert ihrer Zahlungskette zu steigern.