For Franziska Schmid economy and ecology are no contradiction. On the contrary: in the future it can only work together! In her monthly column “Let’s think! Green!” she comments on sustainable developments in the banking and payment sector and calls for more willingness to implement them!

Europe should be climate-neutral by 2050 Various political instruments are being mobilised to achieve this. The EU Commission takes the fight against the climate crisis seriously. Only in the last few days, Ursula von der Leyen announced that within ten years she wants to reduce CO2 emissions to at least 55 percent compared to 1990. This newly planned tightening from the previous 40 to 55 percent is intended to help implement the goal of the Paris Climate Agreement to limit the average global temperature to well below two degrees Celsius.

As early as 2018, the EU provided strong impetus with the action plan. It calls firstly for the reorientation of capital flows towards a more sustainable economy, secondly for the integration of sustainability into banks’ risk management and thirdly for the promotion of transparency and a long-term perspective.

17 SDGs define the goals until 2030

A central element in achieving a more social and sustainable future for all is the 17 Sustainable Development Goals (SDGs). The SDGs were established by the UN and address the global challenges we face: poverty, inequality, climate change, environmental degradation, peace and justice. The SDGs are to be achieved by 2030. however, the implementation of these goals is not yet progressing at the required pace and scope.

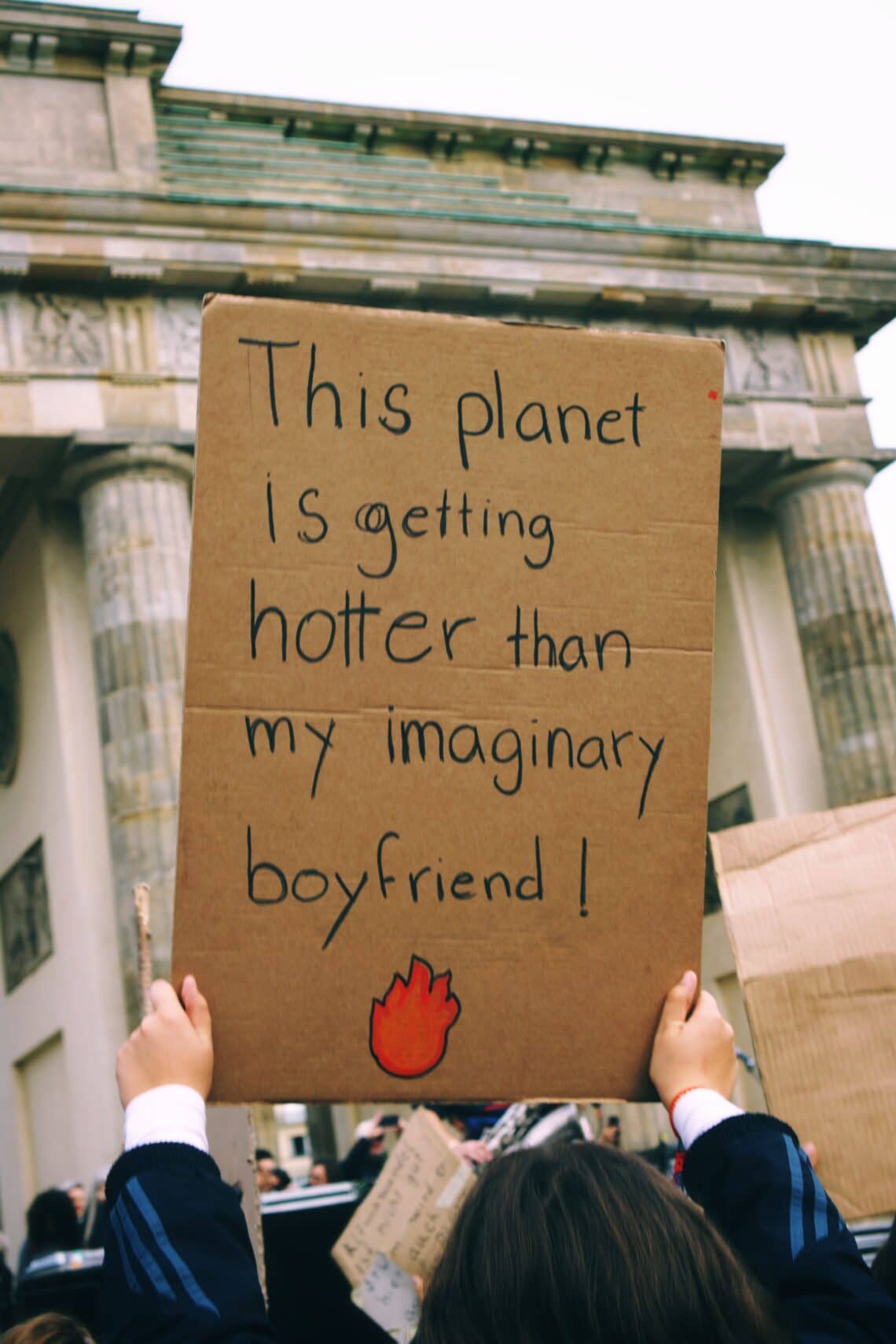

However, the implementation of a climate-friendly economy is not only aimed at the EU level. The population is also becoming increasingly noisy. Fridays for Future and other ecological voices warn the population of the consequences of today’s economy in the future if they do not change their behaviour now.

In order to achieve the agreed reduction in average temperature and the climate targets for 2030, there is currently a lack of 180 billion euros in additional investment each year. Money must be mobilised and urgently invested in climate friendly projects. What is missing to create such an investment gap? Is it due to a lack of financial resources or a lack of opportunities?

Share of sustainable investments rose by 23 per cent.

In 2019, sustainable investments in Germany grew by 23 percent compared to the previous year and now have a volume of 269.3 billion euros. Looking at investor types, the strongest drivers are institutional investors with a market share of around 89 percent. Although the share of private investors grew significantly last year, they still have plenty of room to grow. What are the reasons why predominantly institutional investors make sustainable investments? In the German investment market alone more and more banks and other financial platforms are offering sustainable financial products.

Against this background, the current investment gap in relation to climate targets cannot be justified either by a lack of financial resources or by a lack of investment opportunities. In addition, large sections of the public are increasingly demanding sustainable investments. Are private investors aware that their financial investments also play a decisive role in their sustainability efforts?

One could note provocatively: obviously not. However, the question remains to what extent a sufficient selection of sustainable investments currently exists on the German investment market. Investment providers are not uncreative in any case. They offer everything from ethical to social and green investments. Many investors are faced with the challenge of deciding which sustainable investment fits their needs and values exactly.

German banks must first raise awareness, then the customer

In principle, it is possible to obtain advice on sustainable investments from one of the many German banks. However, ambitious climate savers are often disappointed here. If you ask for more detailed information during the consultation, you often do not have the impression of receiving transparent information. No wonder that private customers are again betting on the good old savings book or overnight money. However, this investment behaviour contributes little to achieving the climate targets.

There are already much more attractive sustainable investment opportunities for private investors abroad. The USA, UK and also Switzerland combine sustainable and mobile investment. With a sustainable investment app, they offer clients the opportunity to invest according to their personal values. In just a few steps, the themes that are to be supported by the personal investment and what not can be selected. The result is possible investment products that are in line with personal goals and values on the one hand and support climate goals on the other.

Wouldn’t it be time for German banks to throw the conventional investment portfolio overboard, offer exclusively sustainable investment products and sensitize their customers accordingly? This would not only help to close the investment gap, but also meet the increased regulatory requirements with regard to sustainability and von der Leyens plans.