Between online banking and branch death

The year 2020 is marked by the corona crisis, which is changing our everyday life and leaving its mark. Many banks were forced to temporarily close branches because of the corona pandemic. Now a considerable number will not even reopen – at the same time, online banking is experiencing great demand in retail banking. WeltSparen, the platform for financial investments, together with Penta, the digital platform for business banking, therefore surveyed more than 2,000 bank customers on their current relationship with banks in a study entitled „Status-quo Quo: Banking 2020 in times of the corona crisis“.

Survey by WeltSparen and Penta: Online banking will continue to gain ground

The future is digital, that’s for sure! Even if Germany is struggling with digitalisation. But the Corona crisis is intensifying the private customer business Clear trend towards online banking clearly. This has now been confirmed by a survey of more than 2,000 participants conducted by WeltSparen, the investment platform, recently together with Penta, the digital platform for business banking.

For the future, 87.9% expect that their children and grandchildren will do their banking exclusively via online banking – completely without physical bank branch.

The current measures taken during the Corona crisis, the past lockdown and the second wave, which many experts believe is likely, could massively strengthen this trend and further thin out the banks‘ branch network.

Does the bank branch have a future?

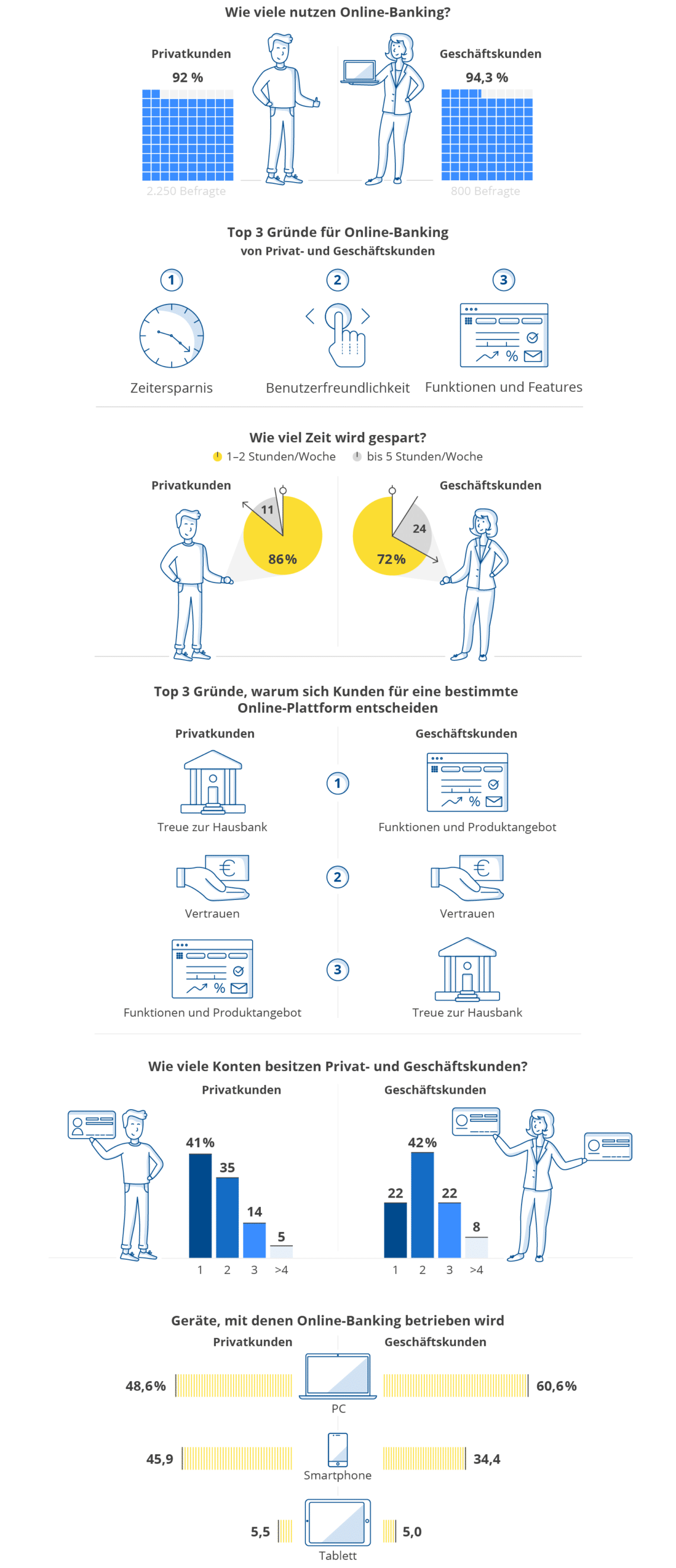

German bank customers are extremely monogamous: 41 percent of those surveyed only have a bank account. Two accounts account for around a third, three bank accounts are used by only 14 percent. Multibanking is still rather the exception, online banking is very popular: almost 40 percent of those surveyed check their account balance online once a week, and almost as many users (36 percent) even log in daily.

It has been foreseeable for some time that the future non-branch is lying. By 2019, according to the Bundesbank, there were only about 27,000 bank branches in Germany. Ten years earlier, the number was around 39,000, a trend that is being fuelled by the corona crisis;

The pandemic has left its mark in many areas of society. And it has not been without effect in banking either. Many banks were forced to take action, to close branches temporarily. Now a considerable part will not reopen at all. As an example, at the height of the Corona crisis, Hamburger Volksbank decided to close 13 of its 28 branches permanently.

Corona accelerated therefore the Trend towards online banking.

Time saving, user friendliness, features instead of branch visits

There are three main advantages to online banking: time savings, user-friendliness and functions. Nearly all respondents (97 percent) say that online banking saves them time. 86 percent expect to spend one to two hours less on managing their finances with online banking. One in ten even believes that they can save up to five hours a week. Over 70 percent also say that the time factor will be the decisive advantage of online banking in the future. For more than 72 percent of those surveyed, user-friendliness is one of the most important advantages of digital banking. What the user experience in a bank branch cannot provide technologically, private customers receive via online banking platforms: For 44 percent, functions and features are an advantage in the digital processing of their banking transactions.

To sum up: The advantages of online banking over visiting a branch are obvious. But why are private customers increasingly using online banking? The survey conducted by WeltSparen and Penta reveals three main aspects:

1. time saving: 96.8 % of those surveyed say they save time by using online banking. 86% expect to spend 1 to 2 hours less per week managing their finances with online banking As many as 11% even believe they can save up to 5 hours. Over 70% also say that the time factor will continue to be the decisive advantage of online banking in the future.

2. user-friendliness: Here, too, a significant proportion of over 72% of those surveyed see a significant advantage in digital banking.

3. functions and features: What the user experience in a bank branch cannot provide technologically, private customers receive via online banking platforms: For 44%, functions and features are an advantage in the digital processing of their banking transactions.

Loyalty to the house bank also for online banking

While private customers have discovered online banking for themselves through the Corona measures at the latest, they still remain loyal online to your house bank. At 51.5%, more than half of the respondents did not choose the online banking they use based on the criteria of time savings, user-friendliness and functions – but simply on which bank is their house bank.

This was accompanied by the fact that for more than 41% of those surveyed Trust an important motivation. From this it can be concluded that the branch business is not coming under pressure due to a lack of trust. Online banking simply offers more functional advantages.

This can also be seen from a look at the topic of multibanking among private customers. 41.4%, the respondents have only one account. Accordingly, the Coronacrise has not contributed to customers looking for new offers via digital channels. The proportion of private customers with two accounts is 32.2%. Three accounts use only 14%.

Regular online banking replaces the visit to the branch

Corona has taught us that there are many things we can do digital …to be able to regulate. Online banking replaces the need to visit a branch: almost 40% of those surveyed check their account balance once a week. The digital routine. Almost as many users – 35.7% – even look at their account balance once a day.

Mobile first? Not with online banking

If banking, it’s not just on the side. More than 46% of those surveyed use the Home computer. How so-called neo-banks, i.e. providers such as N26 or Tomorrow, which focus almost exclusively on online banking with smartphones, can position themselves in the future, remains to be seen. But the chances are good: 45% also use their smartphone for their banking transactions. Only the tablet is far behind and is used by 27% of those surveyed.

All digital? Not when paying

While there is a clear trend towards online banking for managing one’s own finances, there has been a marked increase in Payment method not much done. Although more than half of the respondents use PayPal – probably for online shopping – just as many respondents (51%) still use cash. The credit card (39.4%) and debit card (29.9%) play a minor role in comparison. The main reason for using cash: lack of confidence to the other payment methods. It is therefore not surprising that a large proportion of the survey participants also consider cash to be up-to-date in the future

This is also reflected in the suggestions for improvements in online banking. 38% apparently do not feel secure in the long term and wish for the future additional security measures for cashless payments.

Banks or FinTechs: Where does the future lie?

The Corona crisis has shown private customers that digital banking works well. The majority prefer online banking and see it as the future. But will openness to digital bring other, lasting changes in addition to the slow decline in the number of branches, especially with regard to FinTech’s? For six out of ten Germans, banking and liquidity management is still in the hands of traditional house banks. The young financial companies have significant advantages here: they have digital business models by nature. The entire customer life cycle, from acquisition through to support of existing customers, does not require a conversion to „digital“ as is the case with traditional banks. While traditional banks often build on systems that are decades old, FinTechs use newer technologies and are faster and more flexible in developing customer-oriented solutions. Since FinTechs are technologically up-to-date, they can offer their services at a lower price in some cases. Dr. Tamaz Georgadze, founder and CEO of Raisin, adds: „We are observing a massive digitalization pressure in the banking industry as well as a strongly increasing cooperation between traditional banks and Fintechs. In this way, bank customers benefit from the best of both worlds and banks gain easy access to state-of-the-art technology and modern financial products“.

But will this bring about other, lasting changes besides the slow death of branches, especially with regard to FinTech’s? The young financial companies have some AdvantagesFor example..;

- You have inherited fully digital business models. The entire customer life cycle, from acquisition to servicing existing customers, does not require a conversion to „digital“ as is the case with traditional banks.

- FinTechs usually have a decisive technological advantage. While traditional banks build on systems that are decades old, FinTechs newer technologies and are faster and more flexible in developing customer-oriented solutions.

- The cost factor also plays a role in some offers. Since FinTechs are technologically up-to-date, they can offer their services partially offer at a reduced price.

Do these advantages pay off from the perspective of the respondents? Probably not. A full 60.3% of those surveyed believe that traditional house banks will continue to be responsible for bank and liquidity management in the future. It remains to be seen how lastingly the current situation will influence the behavior of private customers and, if necessary, whether it will lead to a a complete shift to digital banking takes place.

The survey by Penta and Raisin gives a deep insight into the current preferences of private and business customers in banking in the midst of the global corona crisis. Jessica Holzbach, Penta’s Co-Founder and CCO evaluates the results: „We are seeing strong interest in digital financial solutions. It is a fact that for optimal online banking, a number of requirements must be met to make banking exclusively digital. At Penta, we are working on exactly these requirements and our mission is to offer exactly the functions and products that meet the needs of entrepreneurs – always in compliance with regulatory requirements and the highest level of security required“.

It remains to be seen how lastingly the current situation will influence the behaviour of private customers and possibly lead to a complete shift to digital banking.

Here again everything compact as Info graphic:

The study:

The results presented were collected on the basis of a digital survey. Penta Fintech GmbH and WeltSparen, a registered trademark of Raisin GmbH, commissioned the ISO-certified panel provider Gapfish GmbH to conduct the survey and collect the data. For the purpose of the study, 2,250 private individuals and 816 owners, managing directors, self-employed persons and members of senior management were interviewed in July 2020. The temporary survey represents an even distribution in terms of age and gender. According to respondents, 51.7 percent identify themselves as male, 47.8 percent as female, 0.3 percent as diverse and 0.1 percent did not provide any data. The majority of respondents are not customers of Penta or WeltSparen. All participants in the survey were informed about data protection and related rights and informed about the use of the data.

For reasons of better readability, the simultaneous use of the language forms male, female, diverse is omitted throughout the text. All references to persons apply equally to all genders.

„This article first appeared on WorldSaving“